Bandhan Long Duration Fund

Positive Outlook for Bonds: Here's Why

Bloomberg, CEIC, Bandhan MF Research

Financial Times, Invest India

Why Consider Long-Duration Investments Now?

Long Duration funds invest in Debt & Money Market Instruments with Macaulay duration of the portfolio greater than 7 years*. Here's why now is a strategic time to invest in them:

- Maturity Maximization: Ideal for investors looking to enhance portfolio maturity now to avoid future reinvestment at potentially lower rates.

- Capitalizing on Peak Rates: Ideal for investors comfortable with volatility, aiming to leverage the potential peak in interest rates for long-term benefits from declining rates and narrowing spreads between long-term bonds and repo rates.

- Tax Efficiency^: Long-term Mutual Fund investments provide tax-efficient returns, exempt from taxes on coupon earnings or capital gains.

*Macaulay duration

Why Choose Bandhan Long Duration Fund?

Commitment to Quality

Focus on high-quality investments, mainly in PRC-A-rated instruments.*

Diverse Opportunities

Explores opportunities across government and corporate bonds, with a duration that could extend anywhere beyond 7 years.

Robust Track Record

Over 20 years of experience in managing active investment strategies across the yield curve.

Who Should Invest?

Downloads

Make an informed decision. Learn more about investing in Bandhan Long Duration Fund

Fund Facts

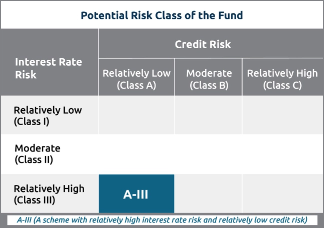

Type of Scheme

An open ended long term debt scheme investing in instruments such that the Macaulay duration of the portfolio is greater than 7 years with Relatively High Interest Rate Risk and Relatively Low Credit Risk

NFO Period

5th to 18th March 2024

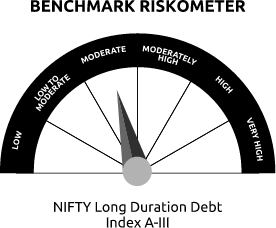

Benchmark

NIFTY Long Duration Debt Index A-III

Fund Managers

Debt portion: Mr. Gautam Kaul

Overseas portion: Mr. Sreejith Balasubramanian (Debt)

Minimum Investment

During New Fund Offer

₹ 1,000

And in multiples of Rs. 1/- thereafter

Exit Load

Nil

Plans/Options

Regular/Direct Plan: Growth Option and Income Distribution cum capital withdrawal Option^

Investment Objective

The scheme seeks to invest in a diversified set of debt and money market securities, such that the Macaulay duration of the Portfolio is greater than 7 years, with the aim of generating optimal returns over long term.

However, there can be no assurance or guarantee that the investment objective of the Scheme will be achieved.

Fund Manager

Mr. Gautam Kaul

Senior Fund ManagerMr. Gautam Kaul is the Senior Fund Manager in the Fixed Income fund management team. With over 20 years of experience, Mr. Kaul brings deep expertise in managing fixed income strategies across the yield curve and has earlier managed assets of ~INR 27,000 crore across active as well as passive strategies.

He was earlier associated with Edelweiss Asset Management Company Ltd. as Fund Manager from December 2016 to November 2021 and was managing various schemes of Edelweiss Mutual Fund. Prior to this, he was also associated with IDBI Asset Management Company Ltd. as Fund Manager from March 2010 to November 2016 and was managing various schemes of IDBI Mutual Fund. His prior associations also include Religare Asset Management Company Ltd., Sahara Asset Management Company Ltd., and Mata Securities India Private Ltd.

Mr. Kaul completed his MBA and Bachelor of Commerce (Accounting & Finance) from the University of Pune.

Overseas portion is managed by Mr. Sreejith Balasubramanian (Debt).

Product info

Bandhan Long Duration Fund

(An open ended long term debt scheme investing in instruments such that the Macaulay duration of the portfolio is greater than 7 years with Relatively High Interest Rate Risk and Relatively Low Credit Risk)

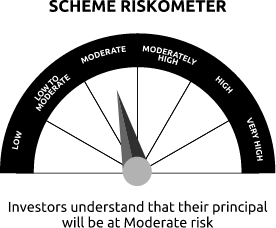

This product is suitable for investors who are seeking*:

- To create wealth over the long term.

- Investments in Debt & Money Market securities such that the Macaulay duration of the portfolio is greater than 7 years.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.