Bandhan Nifty Alpha 50 Index Fund

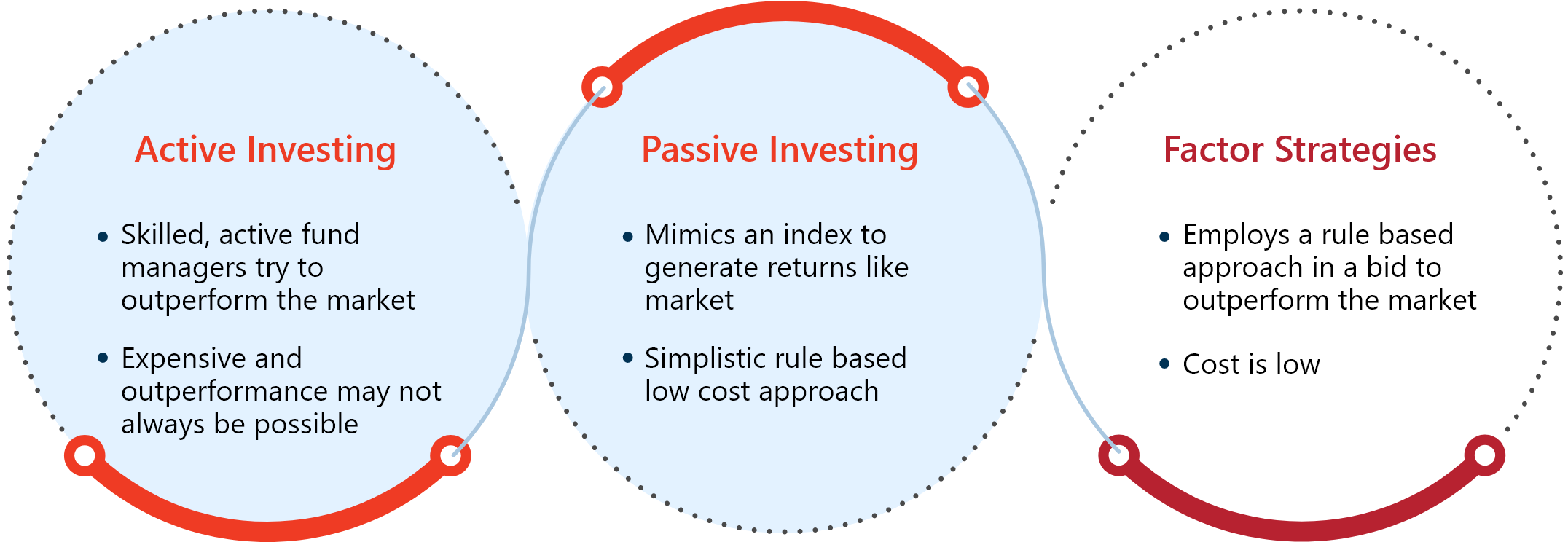

Factor Strategy: The Sweet Spot between Active and Passive

Active Fund Managers have been using Factors to manage Portfolios. While the term 'Factor' maybe new, the concept is not.

When you choose securities with specific factors, it could help you build a portfolio that gives better risk-adjusted returns as compared to the market.

Commonly used Factor Styles

Each factor aims to capture excess returns to stocks as per the characteristics mentioned above.

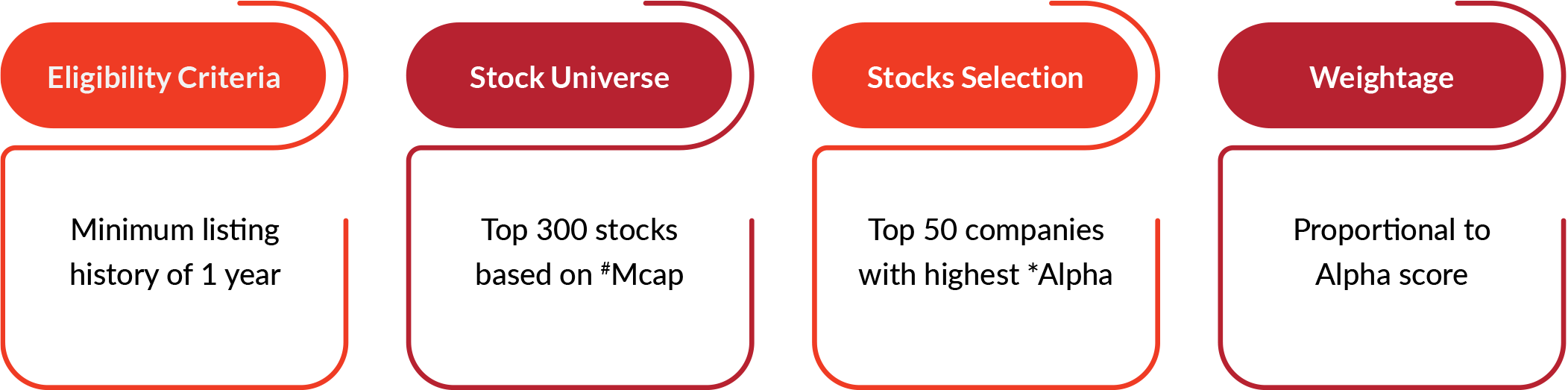

Nifty Alpha 50 Index: The Methodology

^Exercise repeated every 3 months - Mar, Jun, Sep and Dec to determine entry and exit of stocks

*Based on Free Float Market Capitalization

*Jensen’s alpha based on previous one-year returns. For detailed methodology, please click here

^Rebalance effective. The index has a 100% buffer

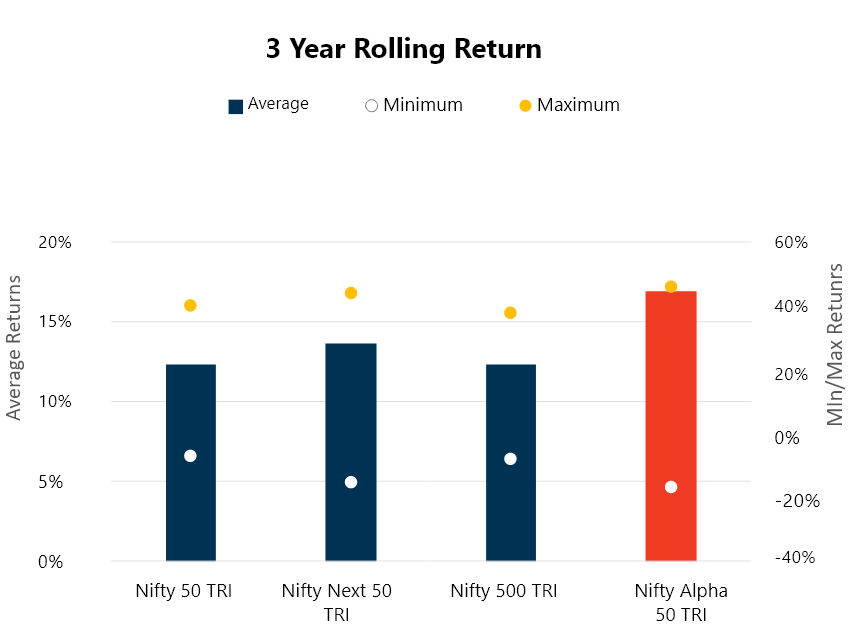

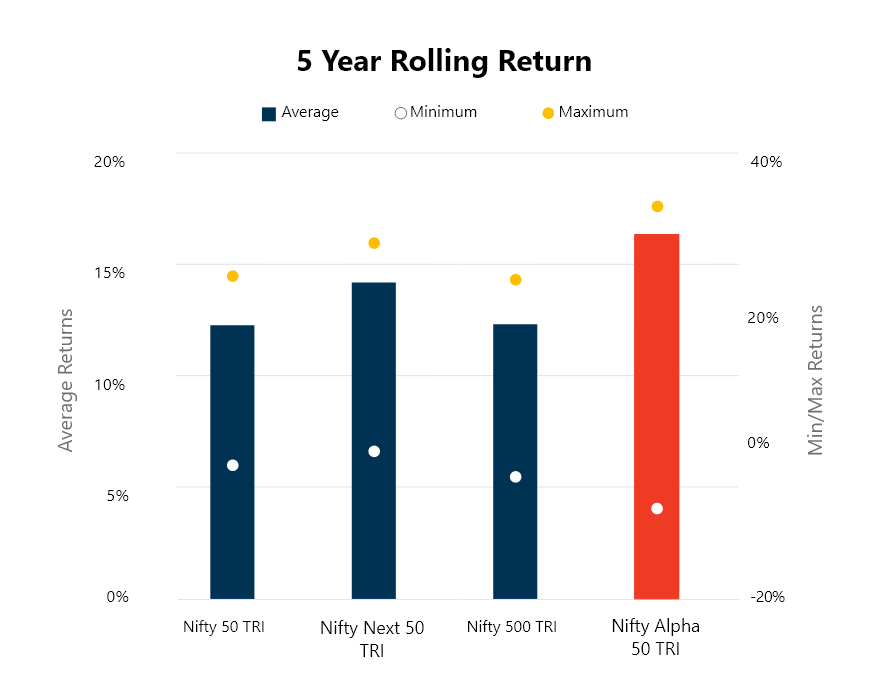

1. Historical Return outperformance vs broader indices

Here are the Rolling Returns of 4 indices over a 3 and 5 year period. The outperformance of this index clearly stands out and makes a compelling case.

Embracing a high-risk, high-reward approach, the strategy may experience short-term fluctuations. However, a more extended horizon showcases reduced volatility and significant alpha generation.

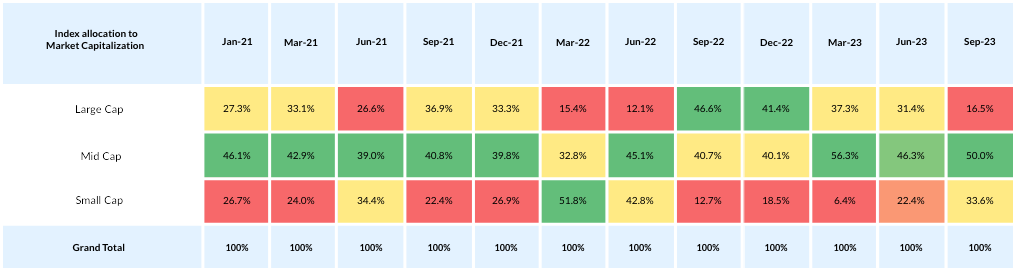

2a. Alpha Factor and Market capitalization rotation

Here is how the Alpha factor changes its exposure within market caps

During bull markets, the Mid and Small-cap segments tend to do well, while during bear markets, Large caps dominate. The Alpha strategy adapts the composition to reflect the changes.

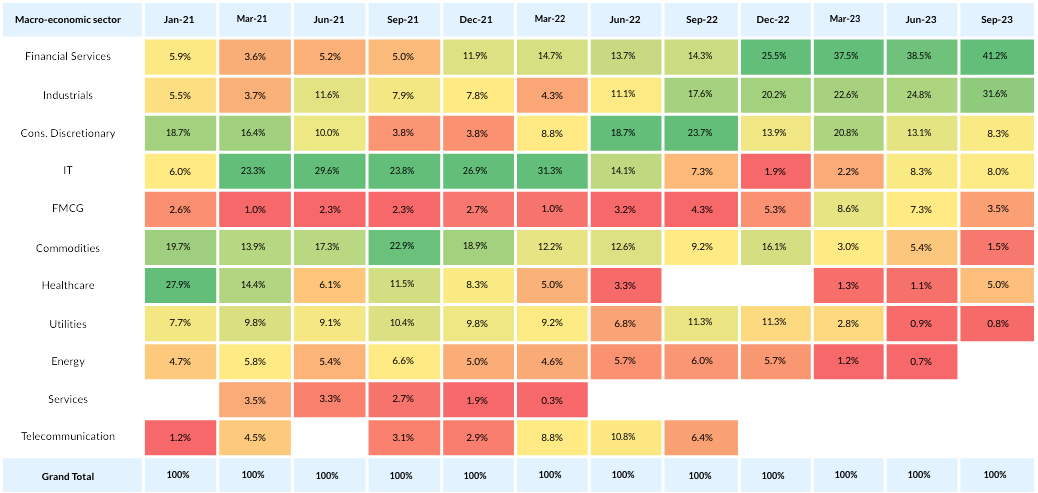

2b. Alpha factor and sector rotation

The Alpha Factor changes it’s sector exposure basis Market or Business Cycle.

Different sectors do well during business cycles; The Alpha strategy captures the sector rotation trend.

3. Alpha Strategy in your Existing Portfolio

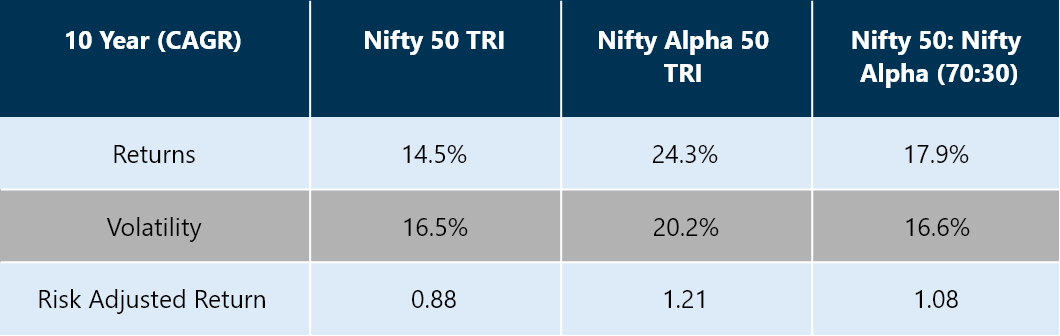

- As you can see from the table alongside, this index has given higher returns over 10 years but volatility has also been high.

- The sweet spot is the 70:30 split between the 2 indices which has given better returns while volatility has increased marginally.

- To put things in perspective, this ratio has grown an investment amount of 1 lakh to 5.2 lakhs over 18 years (growth of 5.2x).

Who can Invest?

Downloads

Make an informed decision. Learn more about investing in Bandhan Nifty Alpha 50 Index Fund

Fund Facts

Type of Scheme

An open-ended scheme tracking Nifty Alpha 50 Index

NFO Period

25th Oct - 6th Nov, 2023

Benchmark

Nifty Alpha 50 TRI

Fund Manager

Mr. Nemish Sheth

Minimum Investment

During New Fund Offer

₹ 1,000

And in multiples of Rs. 1/- thereafter

Exit Load

Nil

Plans/Options

Regular/Direct Plan: Growth Option and Income Distribution cum capital withdrawal Option^

Investment Objective

The investment objective of the Scheme is to replicate the Nifty Alpha 50 index by investing in securities of the Nifty Alpha 50 Index in the same proportion / weightage with an aim to provide returns before expenses that closely correspond to the total return of Nifty Alpha 50 Index, subject to tracking errors. However, there is no assurance or guarantee that the objectives of the scheme will be realized and the scheme does not assure or guarantee any returns.

Fund Manager

Nemish Sheth

Associate Vice President - Equities

Mr. Nemish Sheth is a fund manager at Bandhan AMC (Erstwhile IDFC AMC) since November 2021. He comes with a experience of over decade in fund management and Dealing in Equity, Derivatives and Passive Funds.

His prior stint includes Nippon AMC and ICICI Prudential AMC, as Dealer for Equity, Derivative and Passive Funds.

Mr. Sheth completed his post-graduation in Management Studies with a specialisation in Finance from IES Management College (Mumbai).

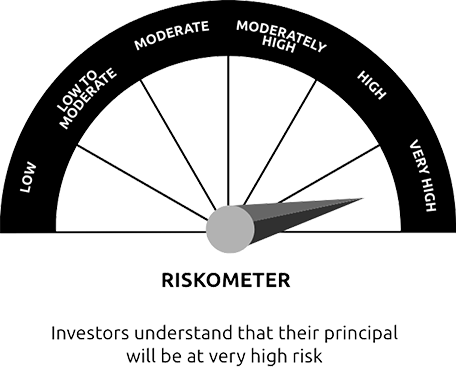

Product info

Bandhan Nifty Alpha 50 Index Fund

(An open-ended scheme tracking Nifty Alpha 50 Index)

This product is suitable for investors who are seeking*:

- Create wealth over a long term

- Investment in equity and equity related instruments belonging to Nifty Alpha 50 Index

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.