Bandhan Core Equity Fund - Direct Plan

Large and Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks

What is the Bandhan Core Equity Fund?

Balancing relative stability with growth potential in your investment portfolio can be challenging, but the Bandhan Core Equity Fund aims to simplify this. It invests in both large-cap and mid-cap stocks, offering a blend of reliability and growth potential, aiming to support your long-term wealth creation goals.

The Bandhan Core Equity Fund is an equity mutual fund scheme that primarily invests in large-cap and mid-cap companies. Large and mid-cap companies are defined by market capitalization and include the top 250 companies in the country. By regulation, large and mid-cap funds must invest at least 35% of their assets in both large-cap and mid-cap stocks, meaning that 70% of the fund's assets are required to be invested in equity and equity-related securities of these companies.

The relatively lower volatility of large-cap stocks, coupled with the growth potential of mid-cap stocks, makes core equity funds well-suited for long-term wealth creation. Risk-averse investors hoping to benefit from mid-cap stocks with less volatility than pure mid-cap funds may consider this option. Core equity funds provide a balance between relative stability and growth potential.

By investing in both large and mid-cap stocks, core equity funds offer diversification across two market capitalizations, which can potentially reduce risk.

- Min Investment 1,000

- Min SIP Amount 100

- Exit Load

a) If redeemed/switched out within 365 days from the date of allotment:

->Upto 10% of investment:Nil,

->For remaining investment: 1% of applicable NAV.

b) If redeemed / switched out after 365 days from date of allotment: Nil. (w.e.f. May 08, 2020)

Scheme is suitable for a minimum investment horizon of more than 3 years

Tier 1 Benchmark : Nifty LargeMidcap 250 Index TRIAlternate Benchmark : Nifty 50 TRI

- Performance

- Portfolio

- Download

- Details

Performance as on 30th September 2024

| Scheme Names | CAGR Returns (%) | Current value of Investment of 10,000 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 year | 3 year | 5 year | 10 year | 09/08/2005 Since inception | 1 year | 3 year | 5 year | 10 year | 09/08/2005 Since inception | |

| Bandhan Core Equity Fund - Regular Plan - Growth | 56.04 | 26.53 | 25.94 | 17.25 | 14.72 | 15,643 | 20,269 | 31,729 | 49,170 | 1,38,718 |

| 43.26 | 21.05 | 25.50 | 17.57 | 16.46 | 14,354 | 17,747 | 31,172 | 50,514 | 1,85,303 | |

| 32.80 | 14.92 | 18.95 | 13.83 | 14.80 | 13,300 | 15,184 | 23,839 | 36,578 | 1,40,802 | |

| ^ Tier 1 Benchmark | ^^ Alternate Benchmark | ^^^ Tier 2 Benchmark | ||||||||||

This fund is managed by Mr. Manish Gunwani (w.e.f 28/01/2023), Mr. Rahul Agarwal (w.e.f 28/08/2023), Mr. Harsh Bhatia (w.e.f 26/02/2024)

View fund performance of other funds managed by Mr. Manish Gunwani, Mr. Rahul Agarwal , Mr. Harsh Bhatia

Past performance may or may not be sustained in future.

Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc.

Taxation:

For taxation, please refer the link : https://bit.ly/46xQzi1

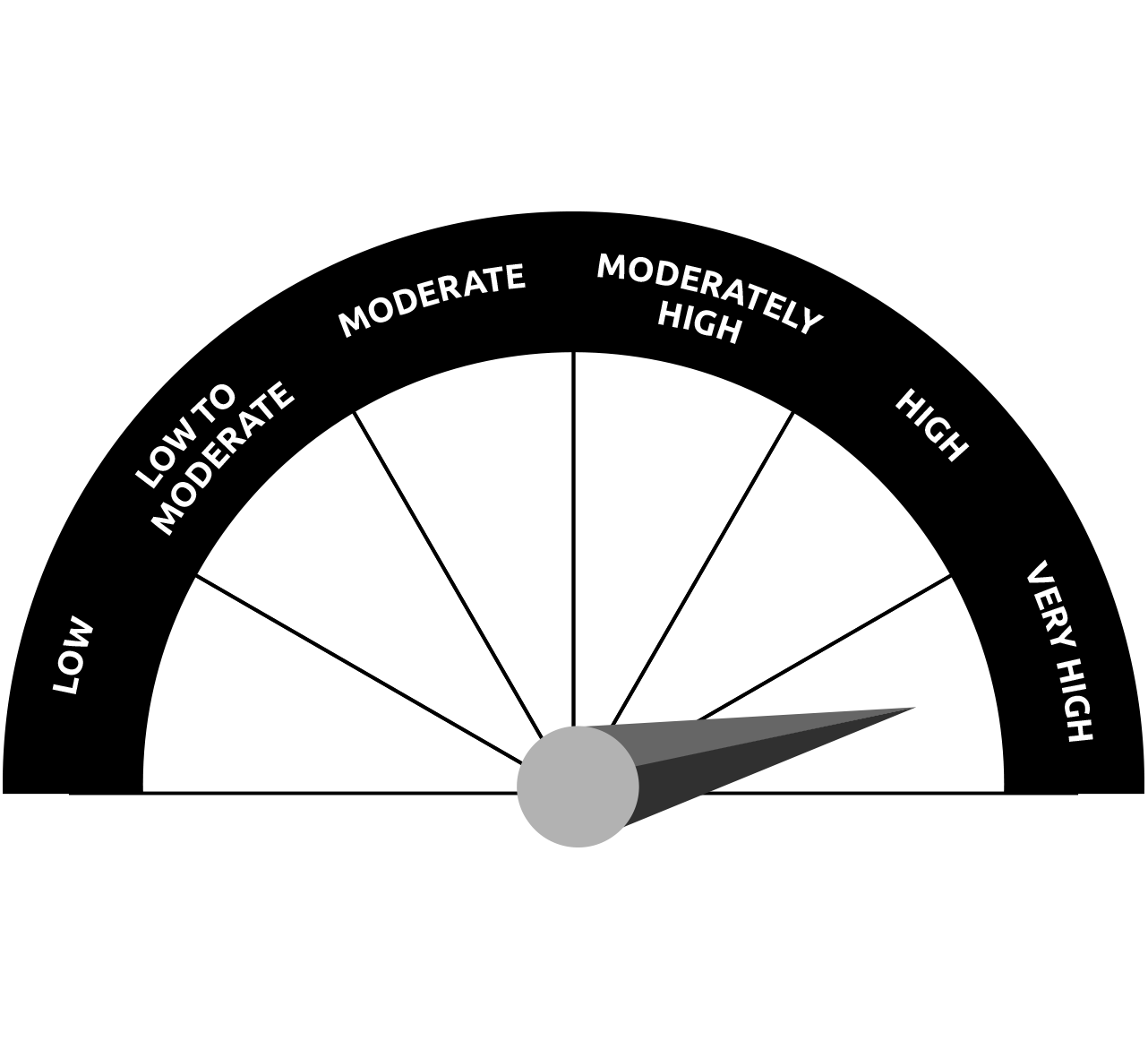

Bandhan Core Equity Fund

(Scheme Risk-o-meter)

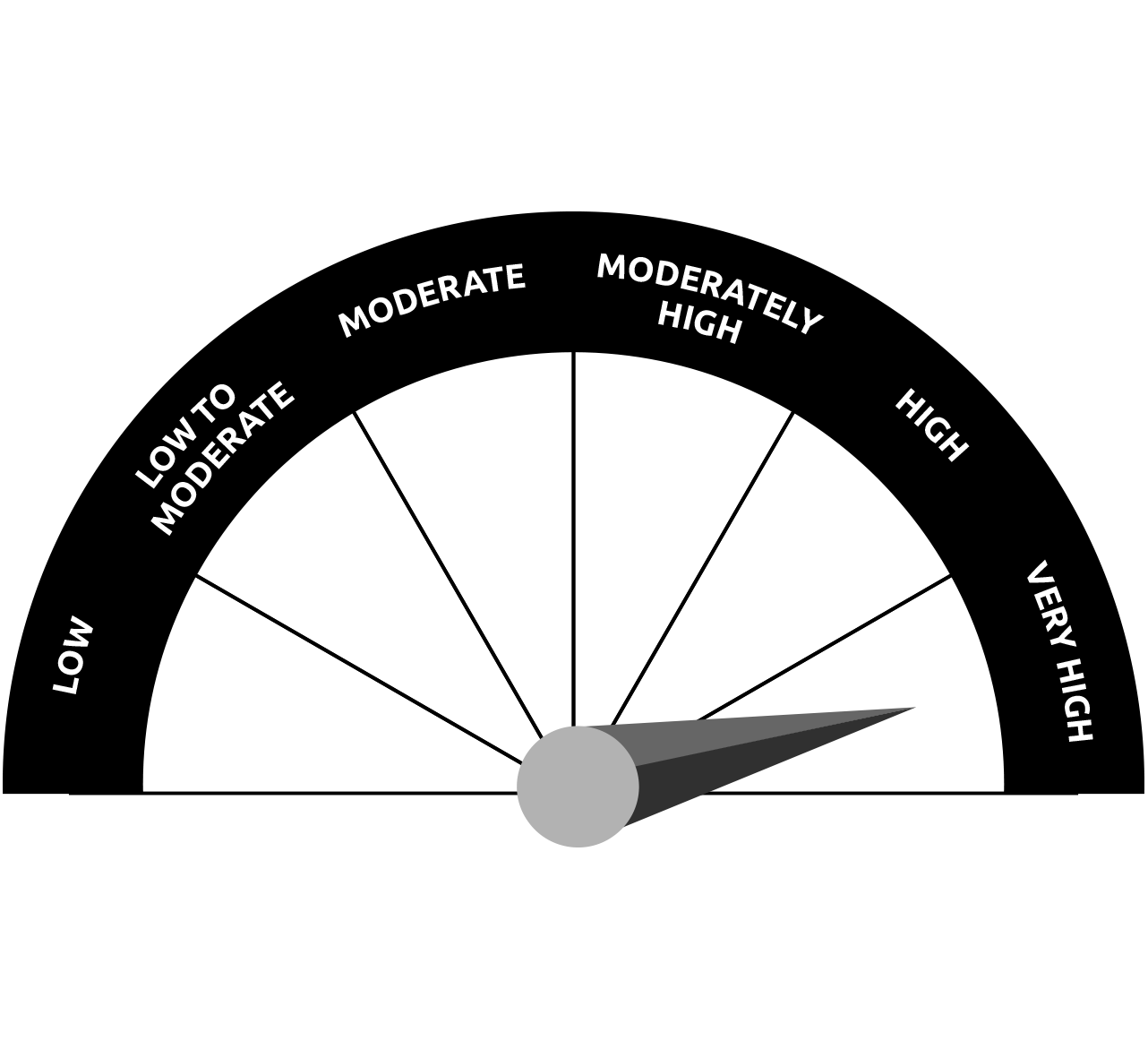

Nifty LargeMidcap 250 Index TRI

(Tier 1 Benchmark Risk-o-meter)

This product is suitable for investors who are seeking* :

- To create wealth over long term.

- Investment predominantly in equity and equity related instruments in large and mid-cap companies.

Who Should Invest in Bandhan Core Equity Fund?

The Bandhan Core Equity Fund is suitable for investors looking to invest in both large-cap and mid-cap companies. While it is classified as a high-risk fund due to its focus on equities, it may be relatively less volatile than pure mid-cap funds. This fund may be ideal for investors with a long-term investment horizon aiming for wealth creation.

FAQs on Bandhan Core Equity Fund

What are Core Equity Funds?

Core Equity Funds are a mutual fund investment scheme which invest in equity and equity-related securities of large and mid-cap companies. They are mandated to invest 35% of their assets in large-cap and mid-cap companies each.

What are the benefits of Large & Mid cap funds?

Large & Mid-cap funds invest in equity and equity related securities of the top 250 companies in India. Investments in large-cap companies make these investments less vulnerable to market volatility and fluctuations. Mid-cap companies have greater potential to grow, and investing in their stocks may benefit in long-term wealth creation.

Are Large and Mid cap funds risky?

Large and Mid-cap funds invest fundamentally in equity securities, thus core equity funds are classified as a high-risk investment option. Equity funds are subject to market risk and are vulnerable to market volatility.

Are Core Equity Funds good for the long-term?

Core Equity Funds are suitable for investors seeking long-term wealth creation as they invest in large and mid-cap companies. Large-cap stocks may potentially be able to withstand market fluctuations, however, they may take time to generate potential returns. Mid-cap stocks have the potential to grow, but may require time.

How are Large and Mid cap funds taxed in India?

Core Equity Funds or Large and Mid cap funds are subject to capital gains tax. If investments are redeemed within a year, they are subject to Short Term Capital Gains Tax (STCG) at 15%. Investments held for beyond one year are subject to Long Term Capital Gains Tax (LTCG). Gains up to ₹1 lakh are tax-free. Anything above ₹1 lakh is taxed at 10%.

Who should invest in Large cap and Mid cap funds?

Investors seeking long-term investments in equity and equity-related securities of large and mid-cap companies may be suited to invest in core equity funds. As these funds invest in equities of large and mid cap companies, they are classified as high-risk investments, and may not be viable for risk-averse investors.