Explore

Bandhan Retirement Fund

Presenting an Equity oriented Retirement Fund with a 5 year lock-in, that follows a Dynamic Asset Allocation strategy.

Have some questions? Get in Touch.

Retirement Planning: The Truth

Here are some interesting facts about the penetration of Retirement planning in India.

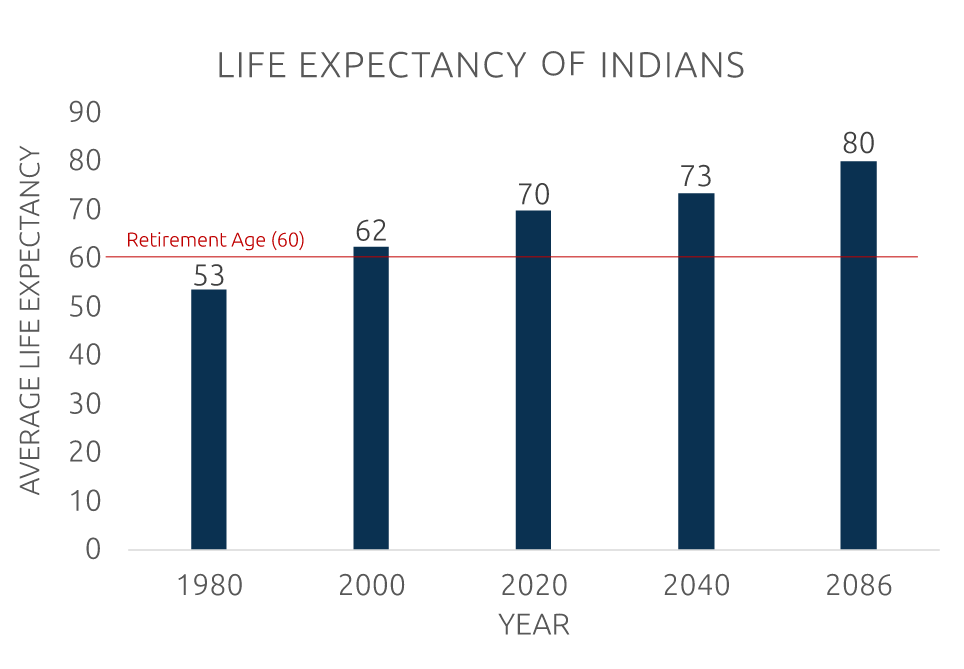

Need for Retirement Planning: Life Expectancy

- Advancement in technology, healthcare and medical sciences has actually increased our Life Expectancy.

- This means we will live longer than the previous generations as you can see from the illustration along-side.

- As life expectancy increases we will need more funds and hence the need to plan for retirement.

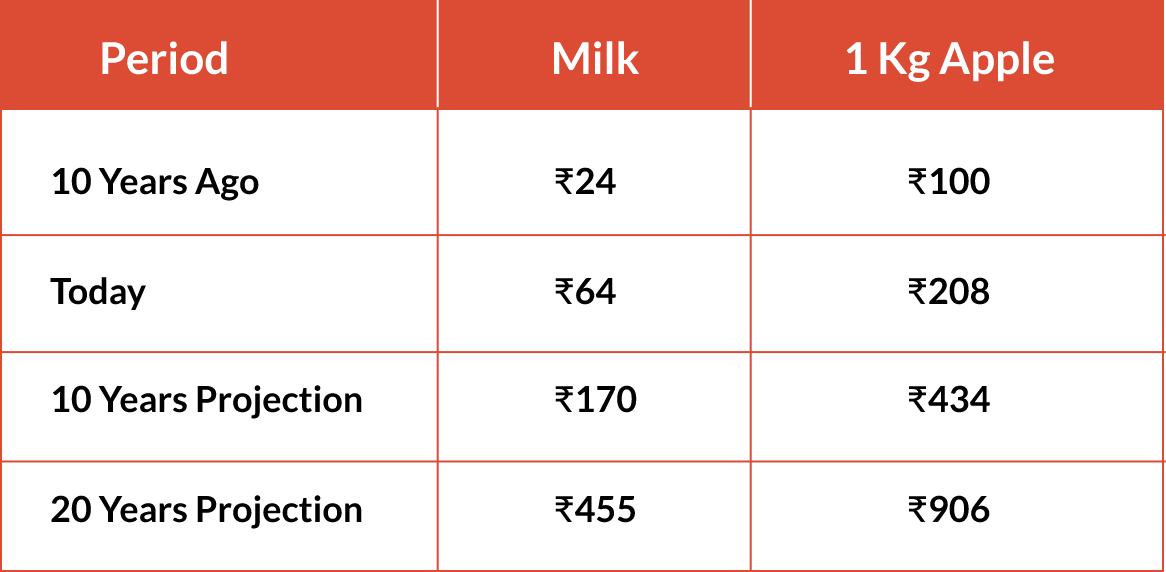

Need for Retirement Planning: Inflation

- Inflation as we know erodes the value of money. So, what we get today for Rs.100 would cost more in the future.

- As you can see from the illustration alongside, Milk is around 166% costlier than what it was around 10 years ago. A kg of Apples are costlier by around 108% today over 10 years ago.

- If this is the rate of inflation one needs to plan well to manage retired life. If you add life expectancy to this equation, then the need for retirement planning becomes sacrosanct.

For Apple (1kg); the current price is from Big Basket. 10 year ago price (Inflation rate of 7.6%)

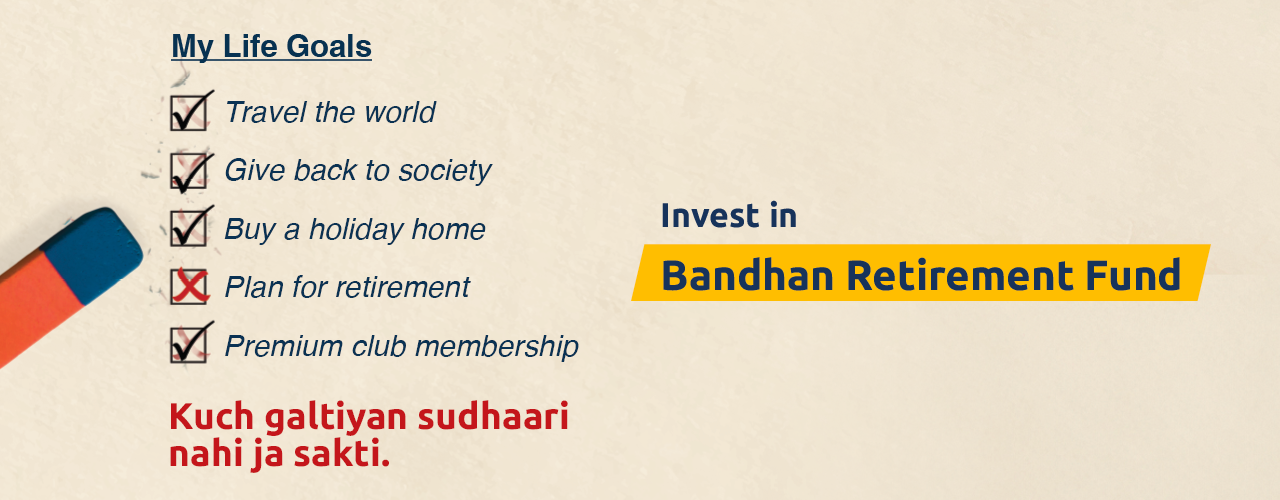

Retirement Planning: What can it Enable?

Why choose a Mutual Fund for Retirement?

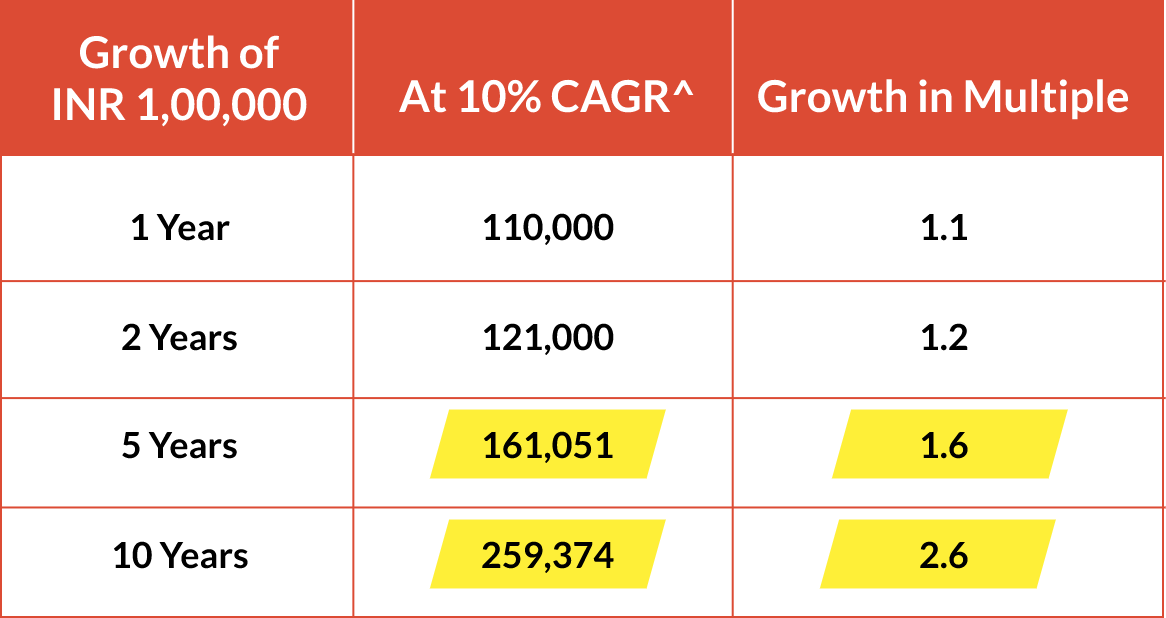

- It is estimated that 50% of equity assets held by retail investors do not remain for more than 2 years (Source: Amfi, data as on quarter ended June 2023)

- As you can see from the illustration alongside, the growth of investment at a CAGR of 10% is gradual for the 1st 2 years but becomes significant by the 5th year and more than doubles over 10 years.

- This is called compounding and generally kicks in by the 5th year and beyond. Compounding is required when the investor is aiming to create wealth.

- As a Retirement Mutual Fund has a lock-in of 5 years you automatically get the benefit of compounding.

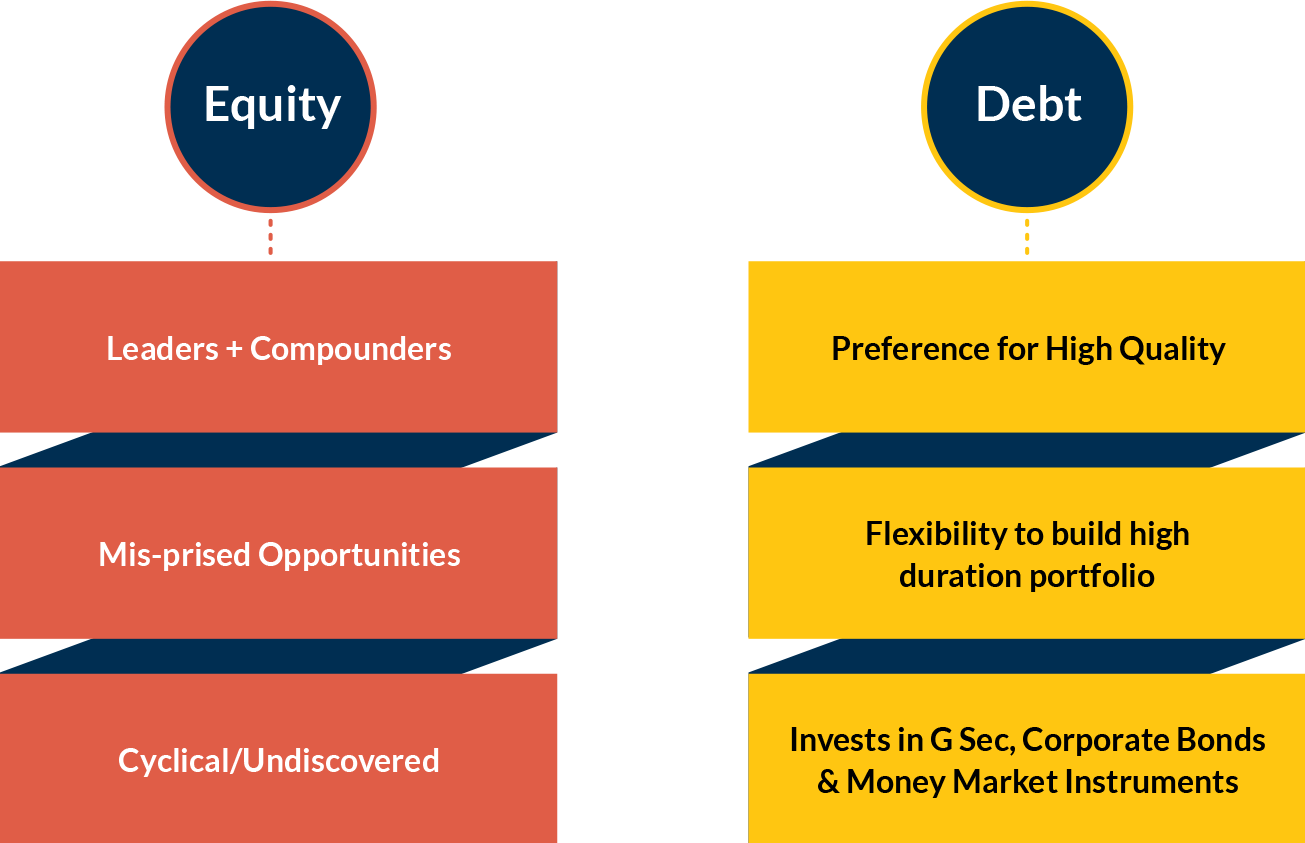

Bandhan Retirement Fund: Construct

- The Bandhan Retirement Fund follows a Dynamic Asset Allocation strategy (just like a Balanced Advantage Fund).

- The Equity exposure in this fund will vary between 30 to 100% and hence Equity Taxation will apply. The maximum Debt exposure will be 35%.

- Exposure to Equity and Debt will be driven by an underlying model unique to Bandhan AMC.

- To summarize, this is an Equity oriented Mutual Fund which has the capability to manage Equity and Debt exposure and has a lock-in of 5 years.

Equity and Debt Investment Philosophy

Who can invest?

Product info

Bandhan Retirement Fund

(An open-ended retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier))

This product is suitable for investors who are seeking*

- Capital appreciation and income generation over long term.

- A hybrid scheme with investment in equity and equity related instruments as well as debt and money market instruments.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Scheme

Benchmark

(CRISIL Hybrid 50+50 - Moderate Index)